BuySellBA

Administrator

One in four buyers has access to credit and prices are rising in the northern neighborhoods of the city - Ambito Finaciero

Source:

www.ambito.com

www.ambito.com

July 17, 2025

By Jose Luis Cieri

Which neighborhoods are leading the rise in used market prices: rising deeds, more transactions with credit leverage, lower margins, and less inventory.

Buildings already inaugurated and others under construction in the area of Arribeños, Campo Salles and Montañeses, in Núñez, one of the neighborhoods that saw the greatest increase in property values in a year.

Mortgage loans have ceased to be a mere expectation and have become a concrete factor in the reactivation of the used real estate market. In May, deed sales increased by 22% compared to April, and 23% of transactions were completed with financing . This is the highest level since 2018. In turn, another 20% of transactions are indirectly linked to credit: these are homeowners relocating after selling to buyers with mortgages. The volume of deed sales reached 5,610 in the month, 8.2 times higher than the May 2020 figure, according to data from the Notaries Association of the City of Buenos Aires.

“Today, approximately 1 in 4 transactions closes with a mortgage. Many families who had been putting off making a decision have already finalized their purchase,” explained Ezequiel Wierzba , CEO of Click. In general, those who access financing allocate average purchases of US$120,000 to buy one- or two-bedroom apartments. There is also a surge in replacement demand: buyers who are already homeowners and are using the opportunity to access a loan to move up to a larger unit.

The rise in credit has changed the neighborhood and price landscape in Buenos Aires. Núñez leads the ranking in year-over-year price increases with a 16.2% increase and an average price of US$3,262 per square meter. Villa Ortúzar follows with a 13.7% increase (US$2,502/m2), and Mataderos, with a 12.3% increase and an average price of US$1,900. Other neighborhoods with notable increases are Coghlan (US$2,526, up 9.5%) and Belgrano (US$2,779, up 7.1%).

“The case of Villa Ortúzar is interesting. It's a neighborhood that absorbed part of the overflow from Villa Devoto, but also from Palermo and Chacarita. When a neighborhood transforms, the surrounding areas also rise. Ortúzar has good connectivity with Lugones, Libertador, and Alcorta, and an urban fabric that is changing. It's a place where new proposals and larger lots are emerging,” said Martín Pinus of Martin Pinus Real Estate.

Pinus also highlighted Núñez as a solid case in point: “The Château Libertador building (on Avenida del Libertador 7000) was a milestone. Then came Quantum Bellini (currently under construction at Del Libertador and Núñez), with large units that sold quickly. That consolidated a demand for good quality that hasn't slowed down.”

The Innovation Park , across from the River Plate club, is also attracting attention with new developments that include housing, offices, coworking spaces, startups, and buildings dedicated to technological innovation and study.

Along the same lines, Diego Lo Nigro of Grupo TGR maintained that proximity to the northern corridor is a key factor. “Neighborhoods like Villa Urquiza, Coghlan, and Saavedra, which until recently were more affordable, have now appreciated in value. They receive an influx of people looking to live close to their work or social spaces. It's an emerging but sustained demand. Furthermore, many companies have relocated to the north of the city or the northern corridor of the province, and that is reshaping preferences,” he explained.

According to the Zonaprop report, the average price in Buenos Aires City is US$2,427 per square meter, a 7% year-over-year increase. The average price for a one-bedroom apartment is US$2,444 per square meter, and for a two-bedroom apartment, it's US$2,411. Two-bedroom units represent 31% of transactions; three-bedroom units, 27%; and townhouses, 16%. Furthermore, there is a new interest in premium units, especially in areas such as Palermo and Recoleta.

The most sought-after neighborhoods remain the traditional ones: Palermo, Belgrano, Núñez, Recoleta, and Colegiales. However, Click has detected growth in Villa Crespo , Chacarita, Paternal, and Villa del Parque, where residents value connectivity, even more affordable prices, and potential for future appreciation.

Current prices per square meter in the most sought-after neighborhoods (used apartments):

With the increase in transactions, the stock of used properties is showing signs of depletion. "If this rate continues, the stock could be depleted in just over a year," warned Mateo García of Toribio Achával.

Although prices rose 20% between 2023 and 2025, they are still below their 2018 highs. Between 2017 and 2023, values fell 49%, leaving room for opportunities in larger or less-demanded units, with greater negotiability.

"Today, there are still apartments under $100,000. When one appears with a good price-quality ratio, it doesn't last long on the market. Those with credit move quickly," Wierzba emphasized.

2-bedroom apartments among the most requested and most purchased by the public

For his part, Francisco Altgelt , of Altgelt Negocios Inmobiliarios, proposed grouping opportunities into three categories: price (properties below market value, such as in the Microcentro), product (uncommon segments, such as premium units), and location (new developments in strategic areas).

The most in-demand apartments are two-bedroom apartments, although we've also noticed a renewed interest in premium units, "something that wasn't the case until last year," Altgelt added.

The segment also argued that credit is driving demand, especially among those who decide to expand and add an additional space. García concluded: "Demand and operations are active. There are always opportunities in a dynamic market."

www.buysellba.com

Source:

Uno de cada cuatro compradores accede a crédito y los precios se recalientan en barrios del norte de la Ciudad

Qué barrios lideran la suba de precios en el mercado del usado: escrituras en alza, más operaciones con apalancamiento crediticio, menor margen y menos stock.

July 17, 2025

By Jose Luis Cieri

Which neighborhoods are leading the rise in used market prices: rising deeds, more transactions with credit leverage, lower margins, and less inventory.

Buildings already inaugurated and others under construction in the area of Arribeños, Campo Salles and Montañeses, in Núñez, one of the neighborhoods that saw the greatest increase in property values in a year.

Mortgage loans have ceased to be a mere expectation and have become a concrete factor in the reactivation of the used real estate market. In May, deed sales increased by 22% compared to April, and 23% of transactions were completed with financing . This is the highest level since 2018. In turn, another 20% of transactions are indirectly linked to credit: these are homeowners relocating after selling to buyers with mortgages. The volume of deed sales reached 5,610 in the month, 8.2 times higher than the May 2020 figure, according to data from the Notaries Association of the City of Buenos Aires.

“Today, approximately 1 in 4 transactions closes with a mortgage. Many families who had been putting off making a decision have already finalized their purchase,” explained Ezequiel Wierzba , CEO of Click. In general, those who access financing allocate average purchases of US$120,000 to buy one- or two-bedroom apartments. There is also a surge in replacement demand: buyers who are already homeowners and are using the opportunity to access a loan to move up to a larger unit.

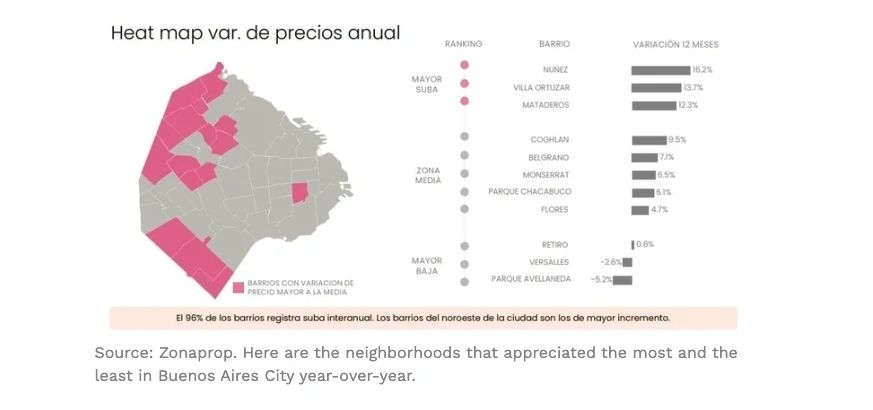

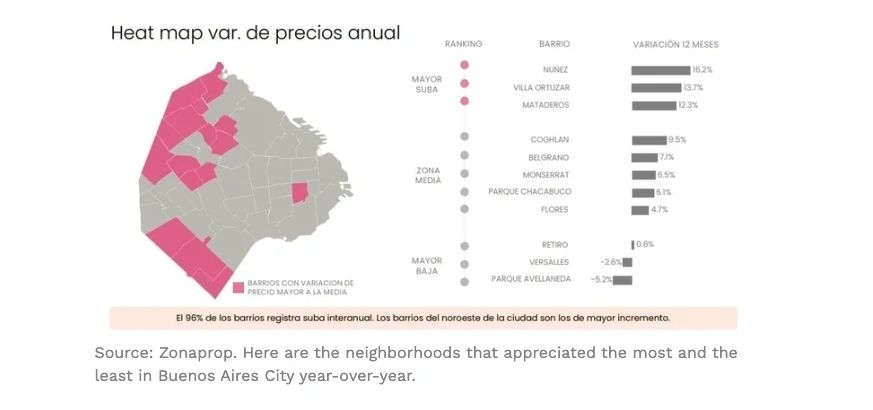

Rising neighborhoods

According to Zonaprop, 96% of neighborhoods have seen year-over-year increases. The northwest neighborhoods of the city have seen the greatest increase.The rise in credit has changed the neighborhood and price landscape in Buenos Aires. Núñez leads the ranking in year-over-year price increases with a 16.2% increase and an average price of US$3,262 per square meter. Villa Ortúzar follows with a 13.7% increase (US$2,502/m2), and Mataderos, with a 12.3% increase and an average price of US$1,900. Other neighborhoods with notable increases are Coghlan (US$2,526, up 9.5%) and Belgrano (US$2,779, up 7.1%).

“The case of Villa Ortúzar is interesting. It's a neighborhood that absorbed part of the overflow from Villa Devoto, but also from Palermo and Chacarita. When a neighborhood transforms, the surrounding areas also rise. Ortúzar has good connectivity with Lugones, Libertador, and Alcorta, and an urban fabric that is changing. It's a place where new proposals and larger lots are emerging,” said Martín Pinus of Martin Pinus Real Estate.

Pinus also highlighted Núñez as a solid case in point: “The Château Libertador building (on Avenida del Libertador 7000) was a milestone. Then came Quantum Bellini (currently under construction at Del Libertador and Núñez), with large units that sold quickly. That consolidated a demand for good quality that hasn't slowed down.”

The Innovation Park , across from the River Plate club, is also attracting attention with new developments that include housing, offices, coworking spaces, startups, and buildings dedicated to technological innovation and study.

Along the same lines, Diego Lo Nigro of Grupo TGR maintained that proximity to the northern corridor is a key factor. “Neighborhoods like Villa Urquiza, Coghlan, and Saavedra, which until recently were more affordable, have now appreciated in value. They receive an influx of people looking to live close to their work or social spaces. It's an emerging but sustained demand. Furthermore, many companies have relocated to the north of the city or the northern corridor of the province, and that is reshaping preferences,” he explained.

According to the Zonaprop report, the average price in Buenos Aires City is US$2,427 per square meter, a 7% year-over-year increase. The average price for a one-bedroom apartment is US$2,444 per square meter, and for a two-bedroom apartment, it's US$2,411. Two-bedroom units represent 31% of transactions; three-bedroom units, 27%; and townhouses, 16%. Furthermore, there is a new interest in premium units, especially in areas such as Palermo and Recoleta.

The most sought-after neighborhoods remain the traditional ones: Palermo, Belgrano, Núñez, Recoleta, and Colegiales. However, Click has detected growth in Villa Crespo , Chacarita, Paternal, and Villa del Parque, where residents value connectivity, even more affordable prices, and potential for future appreciation.

Neighborhoods that increased the most in price

According to Zonaprop, the neighborhoods with the highest price increases in the last year are:- Núñez: +16.2%, u$s3,262/m2.

- Villa Ortúzar: +13.7%, US$2,502/m2.

- Mataderos: +12.3%, US$1,900/m2.

- Coghlan: +9.5%, US$2,526/m2.

- Belgrano: +7.1%, u$s2,779/m2.

Current prices per square meter in the most sought-after neighborhoods (used apartments):

- Palermo: US$3,075/m2.

- Belgrano: US$2,779/m2.

- Villa Urquiza: US$2,529/m2.

- Chacarita: US$2,446/m2.

- Villa Crespo: US$2,202/m2.

- Saavedra: US$2,434/m2.

Haggling and stock drops

The surge in demand impacted negotiation margins. According to sources from the Toribio Achával real estate agency, they currently range between 3% and 5%. In many cases, deals are closed at the listed price. Wierzba noted: "There was an initial transparency regarding prices, and that narrowed the negotiation margin."With the increase in transactions, the stock of used properties is showing signs of depletion. "If this rate continues, the stock could be depleted in just over a year," warned Mateo García of Toribio Achával.

Although prices rose 20% between 2023 and 2025, they are still below their 2018 highs. Between 2017 and 2023, values fell 49%, leaving room for opportunities in larger or less-demanded units, with greater negotiability.

"Today, there are still apartments under $100,000. When one appears with a good price-quality ratio, it doesn't last long on the market. Those with credit move quickly," Wierzba emphasized.

2-bedroom apartments among the most requested and most purchased by the public

For his part, Francisco Altgelt , of Altgelt Negocios Inmobiliarios, proposed grouping opportunities into three categories: price (properties below market value, such as in the Microcentro), product (uncommon segments, such as premium units), and location (new developments in strategic areas).

The most in-demand apartments are two-bedroom apartments, although we've also noticed a renewed interest in premium units, "something that wasn't the case until last year," Altgelt added.

The segment also argued that credit is driving demand, especially among those who decide to expand and add an additional space. García concluded: "Demand and operations are active. There are always opportunities in a dynamic market."

www.buysellba.com