BuySellBA

Administrator

Mortgage loans: fewer and fewer are being granted, and a report predicts that banks will continue to tighten conditions - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

August 22, 2025

A report revealed the number of mortgage loans granted in the first half of 2025.

For the second consecutive month, the number of mortgage loans granted has fallen. Shutterstock

The Argentine mortgage market is experiencing its highest level of activity in six years, but the return of bank financing , which excited all those who dreamed of owning their own home, has begun to lose momentum.

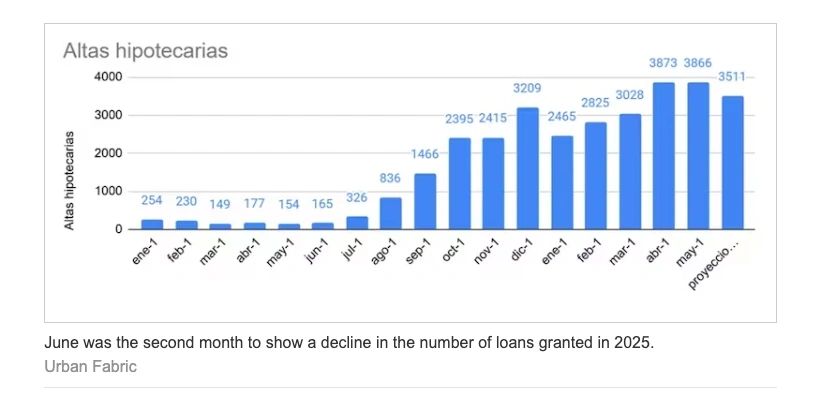

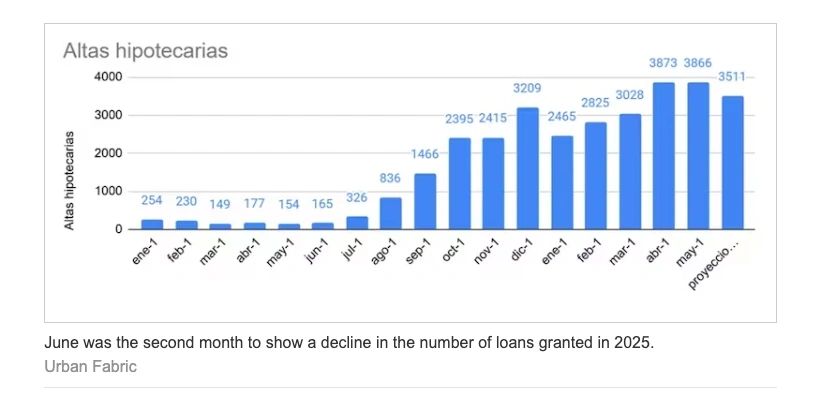

According to a report by the Fundación Tejido Urbano , 3,511 mortgage loans were granted in June , a figure that represents a decrease compared to May (3,866) and marks the second consecutive month of decline, after an explosive start to the year.

According to the survey, 16,057 new mortgages were issued between January and May , 60% more than in all of 2024. The first half of the year is expected to close with more than 19,000 loans granted to individuals , equivalent to a year-over-year increase of 72%. The boost in these transactions was led by home purchases, "which once again became the main destination for credit after having fallen to historic lows in July of last year."

But the reactivation , although powerful, is neither homogeneous nor infinite .

Starting in the second quarter, banks further tightened their conditions and raised interest rates on their UVA loans. This situation is making it increasingly difficult to obtain a loan.

Banks are already anticipating that they could tighten their lending conditions in the coming months, making the situation for potential borrowers increasingly difficult. Moreover, the Central Bank's (BCRA) Credit Conditions Survey reveals that, for the first time since 2022, the proportion of banks that restrict requirements exceeds that of those that relax them .

Even so, demand continues to rise . Half of the banks surveyed reported an increase in applications in the second quarter , compared to just 6% that reported declines. This mismatch between growing demand and declining supply could lead to higher demands, longer approval times, and a slowdown in market expansion. In fact, the volume of mortgage loans granted in June fell 4% compared to the previous month .

UVA (Purchasing Value Unit) mortgages remain the heart of the market. Today , they offer effective annual rates ranging from 8% to 11% , with preferential terms at some public banks. However, access is not universal: "the minimum income requirement and the mortgage-to-income ratio exclude a large segment of potential buyers."

The challenge for the second half of the year will be to sustain the momentum without a parallel increase in bank liquidity. The key will be to find new sources of financing that will ensure the mortgage recovery doesn't become trapped in a premature ceiling.

www.buysellba.com

Source:

Créditos hipotecarios: se otorgan cada vez menos y un informe anticipa que los bancos seguirán endureciendo las condiciones

Un informe reveló la cantidad de préstamos hipotecarios que se entregaron en el primer semestre de 2025

August 22, 2025

A report revealed the number of mortgage loans granted in the first half of 2025.

For the second consecutive month, the number of mortgage loans granted has fallen. Shutterstock

The Argentine mortgage market is experiencing its highest level of activity in six years, but the return of bank financing , which excited all those who dreamed of owning their own home, has begun to lose momentum.

According to a report by the Fundación Tejido Urbano , 3,511 mortgage loans were granted in June , a figure that represents a decrease compared to May (3,866) and marks the second consecutive month of decline, after an explosive start to the year.

According to the survey, 16,057 new mortgages were issued between January and May , 60% more than in all of 2024. The first half of the year is expected to close with more than 19,000 loans granted to individuals , equivalent to a year-over-year increase of 72%. The boost in these transactions was led by home purchases, "which once again became the main destination for credit after having fallen to historic lows in July of last year."

But the reactivation , although powerful, is neither homogeneous nor infinite .

Starting in the second quarter, banks further tightened their conditions and raised interest rates on their UVA loans. This situation is making it increasingly difficult to obtain a loan.

Banks are already anticipating that they could tighten their lending conditions in the coming months, making the situation for potential borrowers increasingly difficult. Moreover, the Central Bank's (BCRA) Credit Conditions Survey reveals that, for the first time since 2022, the proportion of banks that restrict requirements exceeds that of those that relax them .

The reasons behind the rate hike

The reasons are primarily financial: the lack of liquidity on the part of institutions limits banks' ability to sustain the pace of lending, and the absence of a developed secondary market prevents them from recycling portfolios to generate new funding. In this context, mortgage securitization is once again at the center of the debate . In July, ADEBA presented a technical report with proposals to boost this mechanism, considered key to sustaining the credit supply in the medium term.Even so, demand continues to rise . Half of the banks surveyed reported an increase in applications in the second quarter , compared to just 6% that reported declines. This mismatch between growing demand and declining supply could lead to higher demands, longer approval times, and a slowdown in market expansion. In fact, the volume of mortgage loans granted in June fell 4% compared to the previous month .

UVA (Purchasing Value Unit) mortgages remain the heart of the market. Today , they offer effective annual rates ranging from 8% to 11% , with preferential terms at some public banks. However, access is not universal: "the minimum income requirement and the mortgage-to-income ratio exclude a large segment of potential buyers."

The challenge for the second half of the year will be to sustain the momentum without a parallel increase in bank liquidity. The key will be to find new sources of financing that will ensure the mortgage recovery doesn't become trapped in a premature ceiling.

www.buysellba.com