BuySellBA

Administrator

Mortgage lending is cooling off, and doubts about the future are growing - La Nación Propiedades

Source:

¿Llegó a su techo? Se enfría el crédito hipotecario y crecen las dudas sobre su futuro

Los datos de junio encendieron una señal de alarma: cayó el desembolso mensual por primera vez en el año

July 07, 2025

June's data set off an alarm bell: monthly spending fell for the first time this year.

By Candela Contreras

Data on the number of deeds signed with mortgage loans is raising alarm bells in the real estate sector. Daniel Basualdo.

Have they reached their ceiling? That's the question that resonates loudly after the latest mortgage lending data in Argentina became known.

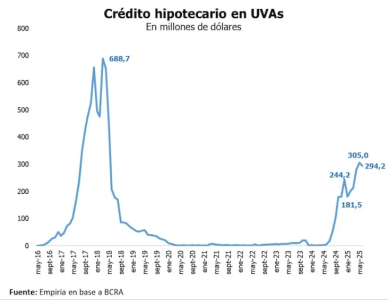

In June, the banking system recorded a decrease in loan disbursements: US$294 million , compared to US$305 million the previous month, according to data shared by the consulting firm Empiria based on the Central Bank.

This figure represents a 3.6% month-on-month drop , in a context in which an upward trend is still maintained year-on-year.

Despite the strong momentum in the first half of the year—almost US$1.5 billion , an amount close to double that of the entire year of 2024—these numbers call into question whether growth has reached its limit or is instead suffering from a technical slowdown that could herald slower lending times for banks. It's important to clarify that loan issuance only began to accelerate in September/October 2024 , so this must be taken into account when comparing it with that year.

Although it is a small decrease, the figure is significant considering that for the past six months, credit has remained stagnant at around US$280-300 million per month .

"The decline is temporary; it's not that pronounced. But I think the point is this: it's hard to grow, this market is really struggling to grow ," analyzes Federico González Rouco, an economist specializing in housing.

Amount of disbursement of the credits granted.

The specialist also explains that for the past few months, an average of US$280 million has been consolidated per month, a reflection of the technical ceiling facing the credit system . This isn't a collapse, he clarifies, but rather a halt at a time when renewed momentum was expected . He said that "most banks are short of credit," and although bank interest rates have generally risen, " the agreed-upon rate, which is 6%, hasn't changed: Banco Nación maintains credit ."

This halt comes at a time when the system's key players expected continued growth, but the numbers and their stability today send a different message. The main question is: why?

The explanations are repeated: on the one hand, the widespread rise in interest rates made installments more expensive and limited access for potential borrowers. On the other hand, the lack of a mortgage capital market (securitization) forces banks to keep all risk on their agenda.

Most private entities are the ones raising rates . This explains the stagnation: even though there is demand, financing is still growing . "The fact that the agreed-upon rate isn't rising and is holding steady means that those who raise rates are fleeing the market," the economist analyzes.

For his part, Alejandro Moretti, a member of the Real Estate Professional Association's Observatory, warns that official data reflects a reality that's already a thing of the past: "The deeds and what's recorded in the Central Bank are a previous snapshot. From the moment the client places the reservation and finally signs the deed, three months pass," he explains.

In this regard, he warns of a new trend that is already beginning to be noticed: "Today, there are fewer inquiries overall about apartment purchases, and within that group, interest in loans has dropped significantly . It's a market that's starting to mature, because sustaining an upward trend for so long is difficult. The fact that interest rates have increased also plays a role , so fewer people can access them."

And he closes with a key fact: "What we're seeing is that in recent weeks there's been less activity. If this isn't reversed, lending will begin to decline. It all has to do with the country's socioeconomic stability . Today, only 24% of buyers qualify for credit ; the rest don't get it."

A brake signal

In May, the province of Buenos Aires reached its highest volume of deeds in the last 13 years. A total of 11,790 sales transactions were signed , representing a year-over-year increase of 24.65% compared to the same month in 2024, according to data from the Buenos Aires Notary Association.

But despite the record, one piece of data raised a red flag: compared to April, the market fell 3.12% , and in particular, the number of mortgage deeds fell more sharply , putting the persistent obstacles to accessing mortgage credit back at the center of the debate.

According to the survey, 1,992 bank-financed transactions were completed in May . Although this number represents the best May since 2018 and a 471% year-over-year increase (last year, only 349 mortgages were signed that month), the monthly figure showed a 6% drop compared to April , when 2,110 deeds with credit were signed.

"In May, we saw the continuation of the year-over-year growth trend we've been observing for several months. Beyond the slight decline compared to April, we continue to see positive signs in the overall market performance," acknowledged Guillermo Longhi, president of the Buenos Aires Association of Notaries.

What needs to happen for the market to readjust?

In recent weeks, several entities have adjusted their rates by between two and five points, making monthly payments more expensive.

To understand the rate hike, it's important to understand the current market situation: demand outstrips supply of funds. Banks finance their portfolios with short-term deposits (generally less than 90 days), while UVA loans extend to 20 or even 30 years . This difference creates tension: "You can't finance for 30 years if your deposits are for 30 days," several specialists analyze.

This gap creates a liquidity problem : every time loans are granted, banks need to fund themselves at a higher rate to maintain their stock. The system's natural response is to raise the Annual Nominal Rate (APR) to moderate access. "There is a huge demand that has grown very quickly, and at the same time, funding mortgage loans is expensive for banks because these loans have very high ticket prices," the economist notes.

This makes loans more expensive and reduces the number of people who can afford to own their own homes.

Therefore, the outlook suggests that this market is going through a period of maturity that requires new tools to recover : long-term funding sources, more competitive rates, public policies that incentivize securitization, and a stable macroeconomic agenda.

www.buysellba.com