BuySellBA

Administrator

Mortgage lending is cooling, but property sales continue to grow: how can this be explained? - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

August 25, 2025

The real estate market showed a new jump in July in transactions carried out both in the City and in the province of Buenos Aires.

Home PurchaseShutterstock - Shutterstock

The Buenos Aires real estate market gained new momentum in July. According to data from the Buenos Aires Notaries Association, 6,651 property deeds were signed , representing a 15% increase compared to June (when 5,762 transactions were completed) and a year-over-year increase of 33%.

The total amount involved in the transactions was $976.906 billion , with a growth of 123.4% compared to the same month in 2024. The average amount of each purchase and sale was $146.8 million (about US$114,840 at the average official exchange rate), 66.2% higher in pesos and 25% more in dollars than a year ago .

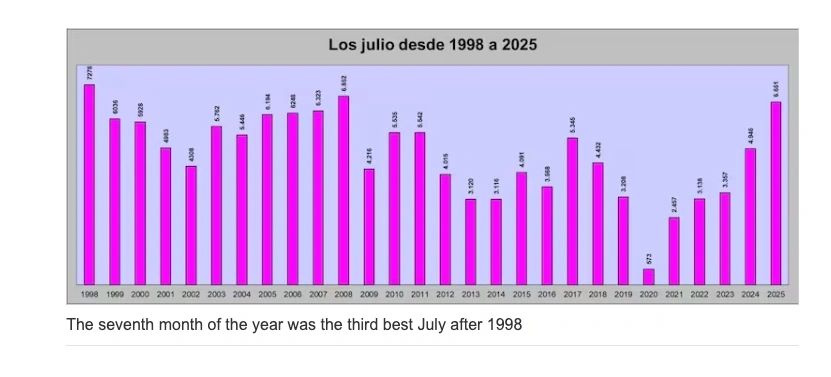

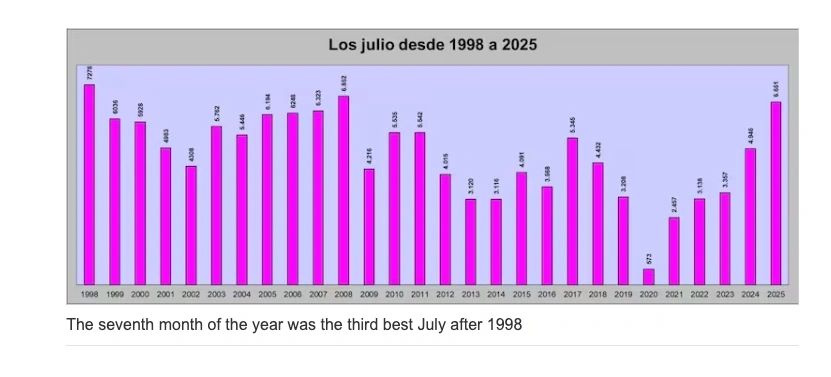

Beyond the monthly comparison, the magnitude of the record positions July 2025 as the third best July in the historical series , surpassed only by the peaks of 1998 and 2008.

"This July is the third-best July in the entire historical series, surpassed only by 1998 and 2008, and it was also the best month for mortgages in seven years, with nearly 1,400 loans. These figures, analyzed together, deserve to be considered because credit continues to drive activity and represents 20% of total sales," the Notaries Association emphasized.

To put this into perspective: By 2018, more than 11,000 had been granted , although that cycle quickly fizzled out with the currency crisis.

The July data confirms that macroeconomic stability is key to sustaining the sector's dynamism. "We believe there is still room for further growth, but we understand that this is part of a macroeconomic process that is still recovering," the entity emphasized. In this regard, new instruments such as divisible mortgages or so-called " deposit-through" loans are beginning to gain ground , which seek to expand financing options in a market that remains in full recovery.

Despite the magnitude of the numbers, mortgage lending is experiencing a ceiling. Since April 2024 , when financing began to recover, the monthly average has hovered around 1,200 mortgages , which indicates a degree of stability rather than sustained growth.

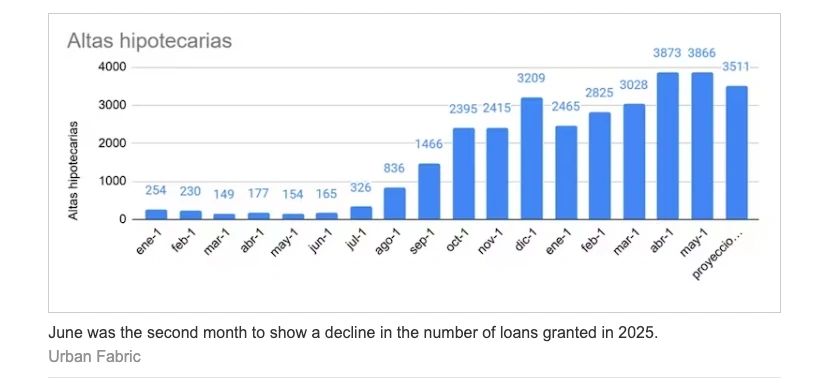

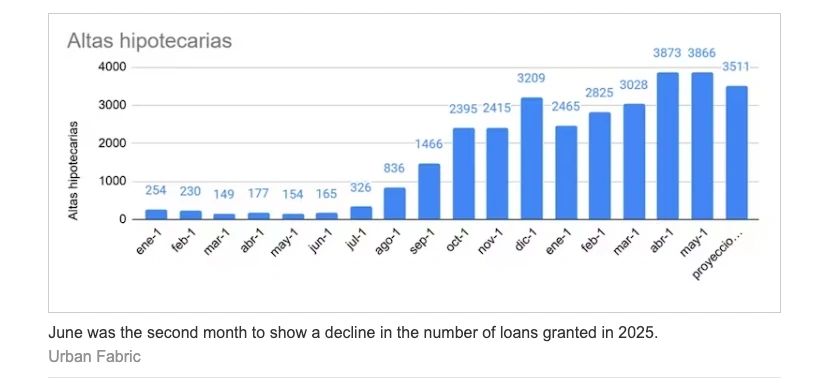

Furthermore, a recent report by Tejido Urbano details that 16,057 new mortgages were signed in the country between January and May , 60% more than in all of 2024, and that the first half of the year is expected to close with more than 19,000 loans issued to individuals (+72% year-on-year). However, the same report warns that a warning sign has appeared in recent months: 3,511 loans were issued in June, compared to 3,866 in May, marking the second consecutive month of decline in loan issuance.

This slowdown has not yet been reflected in the number of mortgage deeds , but it's important to clarify that these transactions were carried out at least three or four months ago, so the slowdown has not yet impacted the data. Furthermore, banks already anticipate tightening loan conditions during the second half of the year. The lack of liquidity in the financial system and the absence of a developed secondary market for recycling mortgage portfolios raise doubts about the ability to sustain this pace in the future.

The most notable growth was in mortgages: 2,169 deeds were signed , representing a 374% year-over-year increase . There was also progress compared to June, with 12% more transactions.

"July's figures show further year-over-year growth, with a very significant increase in mortgages, confirming the importance of credit in the development of the real estate market. This rebound reflects a positive trend that we hope will continue going forward," said Guillermo Longhi, president of the Notaries Association of the Province of Buenos Aires.

www.buysellba.com

Source:

El crédito hipotecario se enfría, pero las ventas de propiedades siguen creciendo: ¿cómo se explica?

El mercado inmobiliario mostró un nuevo salto en julio en las operaciones realizadas tanto en la Ciudad como en la provincia de Buenos Aires

August 25, 2025

The real estate market showed a new jump in July in transactions carried out both in the City and in the province of Buenos Aires.

Home PurchaseShutterstock - Shutterstock

The Buenos Aires real estate market gained new momentum in July. According to data from the Buenos Aires Notaries Association, 6,651 property deeds were signed , representing a 15% increase compared to June (when 5,762 transactions were completed) and a year-over-year increase of 33%.

The total amount involved in the transactions was $976.906 billion , with a growth of 123.4% compared to the same month in 2024. The average amount of each purchase and sale was $146.8 million (about US$114,840 at the average official exchange rate), 66.2% higher in pesos and 25% more in dollars than a year ago .

Beyond the monthly comparison, the magnitude of the record positions July 2025 as the third best July in the historical series , surpassed only by the peaks of 1998 and 2008.

The recovery engine

The driving force behind this recovery was the return of mortgage lending , because, according to specialists, beyond the financing transactions, it drives the market in every sense. In July, 1,393 mortgage deeds were signed , representing a 519% year-over-year increase . So far in 2025, there have already been 8,003 credit transactions , a figure not seen for more than seven years."This July is the third-best July in the entire historical series, surpassed only by 1998 and 2008, and it was also the best month for mortgages in seven years, with nearly 1,400 loans. These figures, analyzed together, deserve to be considered because credit continues to drive activity and represents 20% of total sales," the Notaries Association emphasized.

To put this into perspective: By 2018, more than 11,000 had been granted , although that cycle quickly fizzled out with the currency crisis.

The July data confirms that macroeconomic stability is key to sustaining the sector's dynamism. "We believe there is still room for further growth, but we understand that this is part of a macroeconomic process that is still recovering," the entity emphasized. In this regard, new instruments such as divisible mortgages or so-called " deposit-through" loans are beginning to gain ground , which seek to expand financing options in a market that remains in full recovery.

Despite the magnitude of the numbers, mortgage lending is experiencing a ceiling. Since April 2024 , when financing began to recover, the monthly average has hovered around 1,200 mortgages , which indicates a degree of stability rather than sustained growth.

Furthermore, a recent report by Tejido Urbano details that 16,057 new mortgages were signed in the country between January and May , 60% more than in all of 2024, and that the first half of the year is expected to close with more than 19,000 loans issued to individuals (+72% year-on-year). However, the same report warns that a warning sign has appeared in recent months: 3,511 loans were issued in June, compared to 3,866 in May, marking the second consecutive month of decline in loan issuance.

This slowdown has not yet been reflected in the number of mortgage deeds , but it's important to clarify that these transactions were carried out at least three or four months ago, so the slowdown has not yet impacted the data. Furthermore, banks already anticipate tightening loan conditions during the second half of the year. The lack of liquidity in the financial system and the absence of a developed secondary market for recycling mortgage portfolios raise doubts about the ability to sustain this pace in the future.

The situation in the province of Buenos Aires

The positive trend was also reflected in the Province of Buenos Aires. According to statistics from the Buenos Aires Notary Association, 13,334 sales were completed in July , 41% more than in the same month of 2024 (when there were 9,449). Compared to June of this year (11,706 transactions), the increase was 14% .The most notable growth was in mortgages: 2,169 deeds were signed , representing a 374% year-over-year increase . There was also progress compared to June, with 12% more transactions.

"July's figures show further year-over-year growth, with a very significant increase in mortgages, confirming the importance of credit in the development of the real estate market. This rebound reflects a positive trend that we hope will continue going forward," said Guillermo Longhi, president of the Notaries Association of the Province of Buenos Aires.

www.buysellba.com