BuySellBA

Administrator

Mortgage lending fell in August: the number of loans granted was revealed - La Nacion Propiedades

Source:

www.lanacion.com.ar

www.lanacion.com.ar

September 08, 2025

The interest rate hikes of recent months have already begun to be felt in the market and the impact was not long in coming.

By Candela Contreras

Banks' demands are becoming more and more restrictiveSaiArLawKa2 - Shutterstock

Mortgage lending is slowly crumbling . After the constant rise in interest rates that banks are applying to their loans, new restrictions have been added: Banco Nación has increased its credit scoring requirements . This means that a near-perfect credit profile is now required to enter the credit race.

The reasons behind this tightening are multiple: a lack of funding for banks to lend a significant amount of money over 20 or 30 years, pre-election uncertainty , rates that make installments more expensive , and a country risk that keeps the financial system on alert.

"It's not that banks are formally rejecting all loans, but rather that they are making them more restrictive and difficult to sustain," explains Daniel Bryn, head of Invertire Real Estate .

As a result, real estate market analysts assert that "the credit ceiling has already arrived ," and that all that remains is to wait and see how it will impact future sales and property prices. At the same time, the rise in the dollar has left many people unable to access housing. These are people who were eligible months ago and now are no longer eligible.

This ceiling can already be seen in the amount of money disbursed in the market for loans granted. In August, mortgage lending fell 3% compared to the previous month.

Although this number isn't yet particularly impressive, it's worth noting that loans take between three and four months to be issued, so these numbers correspond to clients who applied before May.

"The strongest impact will be in September, due to the increase in bank restrictions. If this is the ceiling (very possible, at least for a while), it will be well below the 2017-2018 level," said Federico González Rouco, an economist at the consulting firm Empiria.

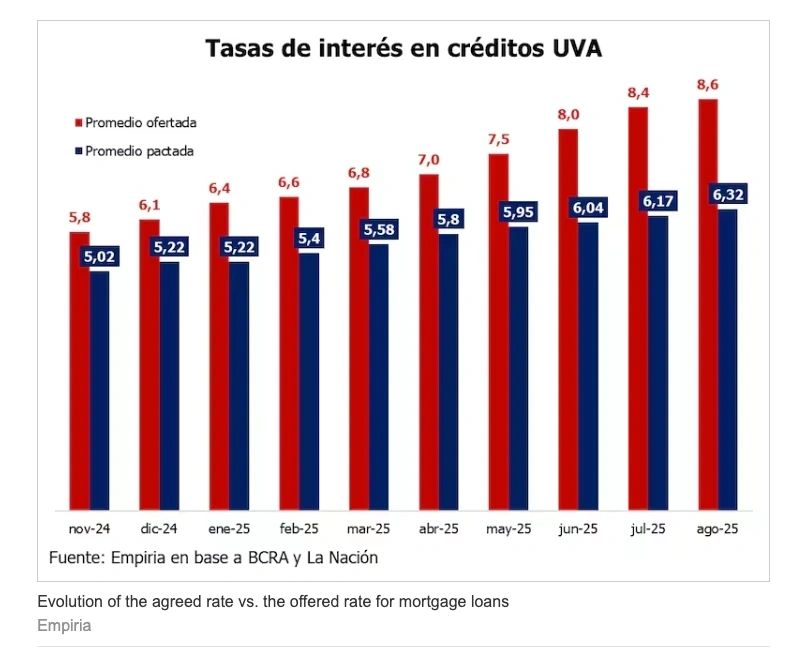

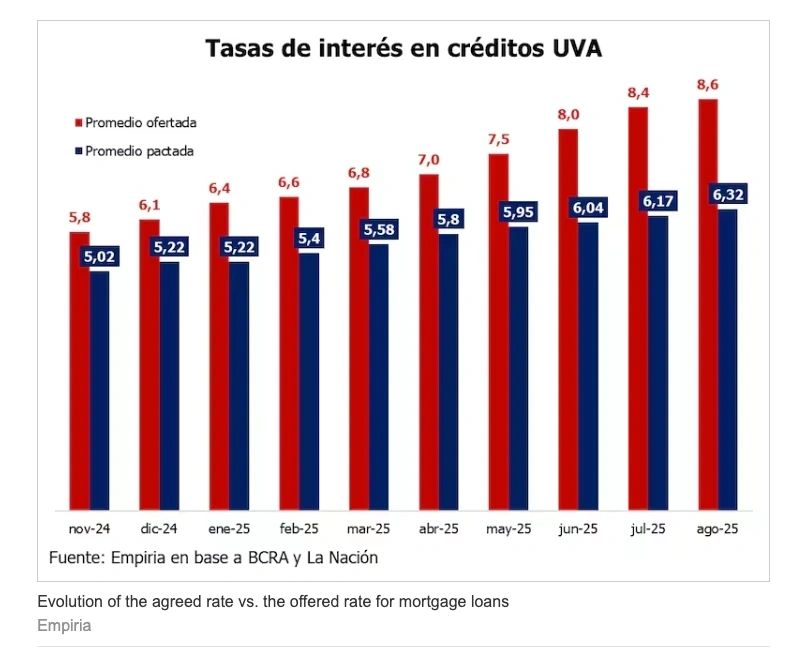

Regarding the average interest rate on loans agreed upon in August, it was learned to be 6.3% , 1.5 percentage points higher than September 2024. Meanwhile, the average rate at which banks offer loans was 8.6% . "That gap of just over two percentage points is due to the time it takes for a loan to be approved and disbursed," explains González Rouco.

Evolution of the agreed rate vs. the offered rate for mortgage loans. Empiria

In concrete numbers, US$308.9 million in mortgage loans were disbursed in the eighth month of the year, with approximately four thousand loans.

Along the same lines, González Rouco acknowledged that "the outlook for the coming scenario is different with or without credit. The market was structured to have financing, so if there's no credit, it will have to restructure itself again or wait for everything to rearrange itself next year and mortgage financing to return."

Added to this is the lack of liquidity in banks . "If there isn't a government that ensures banks have liquidity, it's practically impossible. I think this is the ceiling; operations are already declining ," the economist said.

The combination: loans with prohibitive rates for many , requirements that act as additional filters , and a rising dollar jeopardize access to homeownership. Transactions are plateauing while others are falling through . For specialists, many of the answers to what will happen next will be available after the election results.

www.buysellba.com

Source:

En agosto cayó el crédito hipotecario: se conoció el dato de la cuántos préstamos se otorgaron

Las subas de las tasas de interés de los últimos meses ya empezó a sentirse en el mercado y el impacto no se demoró en llegar

September 08, 2025

The interest rate hikes of recent months have already begun to be felt in the market and the impact was not long in coming.

By Candela Contreras

Banks' demands are becoming more and more restrictiveSaiArLawKa2 - Shutterstock

Mortgage lending is slowly crumbling . After the constant rise in interest rates that banks are applying to their loans, new restrictions have been added: Banco Nación has increased its credit scoring requirements . This means that a near-perfect credit profile is now required to enter the credit race.

The reasons behind this tightening are multiple: a lack of funding for banks to lend a significant amount of money over 20 or 30 years, pre-election uncertainty , rates that make installments more expensive , and a country risk that keeps the financial system on alert.

"It's not that banks are formally rejecting all loans, but rather that they are making them more restrictive and difficult to sustain," explains Daniel Bryn, head of Invertire Real Estate .

As a result, real estate market analysts assert that "the credit ceiling has already arrived ," and that all that remains is to wait and see how it will impact future sales and property prices. At the same time, the rise in the dollar has left many people unable to access housing. These are people who were eligible months ago and now are no longer eligible.

This ceiling can already be seen in the amount of money disbursed in the market for loans granted. In August, mortgage lending fell 3% compared to the previous month.

Although this number isn't yet particularly impressive, it's worth noting that loans take between three and four months to be issued, so these numbers correspond to clients who applied before May.

"The strongest impact will be in September, due to the increase in bank restrictions. If this is the ceiling (very possible, at least for a while), it will be well below the 2017-2018 level," said Federico González Rouco, an economist at the consulting firm Empiria.

Regarding the average interest rate on loans agreed upon in August, it was learned to be 6.3% , 1.5 percentage points higher than September 2024. Meanwhile, the average rate at which banks offer loans was 8.6% . "That gap of just over two percentage points is due to the time it takes for a loan to be approved and disbursed," explains González Rouco.

Evolution of the agreed rate vs. the offered rate for mortgage loans. Empiria

In concrete numbers, US$308.9 million in mortgage loans were disbursed in the eighth month of the year, with approximately four thousand loans.

What will happen to the credits?

Fabián Achával, owner of the real estate company of the same name, gave a forecast to the market: "The granting of mortgage loans will slow down significantly, and that will have a multiplier effect on other transactions due to the same market chain effect ," adding that they must wait for this turbulence to calm down, "even though everything will depend on what happens with the elections."Along the same lines, González Rouco acknowledged that "the outlook for the coming scenario is different with or without credit. The market was structured to have financing, so if there's no credit, it will have to restructure itself again or wait for everything to rearrange itself next year and mortgage financing to return."

Added to this is the lack of liquidity in banks . "If there isn't a government that ensures banks have liquidity, it's practically impossible. I think this is the ceiling; operations are already declining ," the economist said.

The combination: loans with prohibitive rates for many , requirements that act as additional filters , and a rising dollar jeopardize access to homeownership. Transactions are plateauing while others are falling through . For specialists, many of the answers to what will happen next will be available after the election results.

www.buysellba.com