BuySellBA

Administrator

Mortgage boom: 3,000 loans are being granted per month, and they expect to exceed 30,000 this year - Ámbito Financiero

Source:

Boom hipotecario: se otorgan 3.000 préstamos por mes y prevén superar 30.000 en el año

Cuáles son los aspectos a mirar antes de tomar un crédito: el anticipo, la tasa, y el rol de los bancos públicos que mantienen condiciones más competitivas.

July 04, 2025

What aspects to consider before taking out a loan: the advance payment, the rate, and the role of public banks that offer more competitive conditions.

By José Luis Cieri

The rise in mortgages is one of the most significant factors in the real estate market today. For many buyers, it means the possibility of owning their own home after years of a virtually paralyzed market.

The Argentine mortgage market is experiencing one of its most dynamic periods in years. After a period of near-total paralysis, nearly 3,000 loans are now being issued per month nationwide, and specialists project that this figure could exceed 30,000 before the end of 2025. This figure marks the most significant recovery since 2018, the last year with comparable levels (according to the Central Bank, an estimated 49,000 loans were issued by mid-2018, before the collapse of UVA loans and the currency crisis in the middle of that year) .

Official statistics clearly show this recovery. According to the Notaries Association of the City of Buenos Aires , 1,300 real estate mortgage transactions were completed in May in Buenos Aires, a figure that confirms the recovery in the country's main market.

In the Province of Buenos Aires, a record high was reached in the last 14 years, with nearly 1,900 mortgage deeds issued. Between February and May, each month alone surpassed the number of mortgages granted in all of 2024. From January to May 2025, 8,327 mortgage transactions were completed, with a monthly average of 1,665, well above the 1,388 mortgages registered during the same period last year.

Reasons behind the rebound

The mortgage lending boom is not an isolated phenomenon: it is related to a relatively more stable macroeconomic environment, sustained demand for home purchases, and the decision by public banks to maintain lower rates than the rest of the market.

In the Buenos Aires real estate market, the real estate agencies surveyed agree that inquiries to purchase with credit continue. Used properties , in particular, are experiencing a strong trend compared to new or under-construction units, which are currently less affordable due to the high cost of construction.

For buyers, credit is once again a viable option. Current mortgages typically offer installments close to the equivalent of rent, making buying an attractive option for those with the initial savings to cover the down payment.

Balance

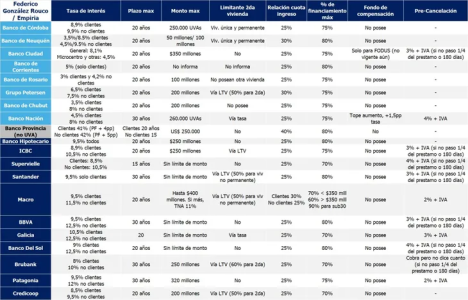

For Federico González Rouco , an economist specializing in the real estate market at Empiria Consultores, the market has found a degree of balance despite the interest rate hikes in the financial system. “It has been stable for several months now. Some banks raised rates by half a point or one point, but not all. Public banks, except for Bancor de Córdoba, did not raise their rates (see chart), and the market remains more or less unchanged,” he explained.

Source: Economist Federico González Rouco-Empiria

“Growth appears to have slowed, but not demand. The rate hike stabilized these lending levels. With lower rates, we would have seen even more growth. Today, loans are being moved around $300 million per month, with approximately 3,000 loans per month, and there is room to sustain this level for many months to come,” he explained.

According to González Rouco, a drastic change in the foreign exchange market would be necessary to break this scenario: "To puncture this volume of credit, there would have to be a very large swing in the exchange rate, and I don't see that on the horizon. The stable dollar offsets the interest rate hike. Obviously, the interest rate hike limits access, but salary increases in dollars have improved the ability to pay, so we've maintained this balance for several months."

When asked what strategy is best for those considering a loan today, he was clear: “Actually, the down payment is a personal financial issue, but today, with the dollar at this value, I think it's best to try to get as much credit as possible. Get the most financing from the bank and, if you have dollars, don't use them. Although a lot depends on each person's ability to pay. Of course, the interest rate is essential.”

Vision and coincidence

Fernando Álvarez de Celis, executive director of the Tejido Urbano Foundation, agreed that the current outlook is positive. “The outlook remains encouraging. The number of loans granted this year already exceeds the total number granted in 2024. The latest data from the Notaries Association of the City of Buenos Aires continues to show encouraging figures. The number of loan applications from banks is significant, and apartment prices and the value of the dollar are two factors that support this positive trend,” he described.

Regarding the impact of the interest rate hike on demand, he clarified that while there have been adjustments, the situation remains competitive at the major banks: “Some banks have raised rates, but the main mortgage lenders, Banco Nación , Banco Galicia, and Banco Ciudad, continue to have very competitive rates, and this also indicates the positive momentum for mortgage lending. It's true that not even the banks themselves expected this boom in transactions, and they are developing financial tools that allow them to keep up.”

Regarding projections for the remainder of the year and 2025, he was optimistic: "If macroeconomic variables remain stable, I see 2025 with very strong demand for mortgage loans. I would say we would surpass 2018 and reach the record number of transactions since 1997."

Finally, regarding advice for those considering taking out a loan today, he emphasized that there is no single recipe.

Among those who were able to obtain a mortgage loan, housing transactions for less than US$120,000 prevailed.

“It's very difficult to answer because it depends a lot on each individual's situation. Generally speaking, people compare the installment with the cost of rent. I would advise looking at the number of years: perhaps there isn't that much difference between a 15- or 20-year loan, and you pay five years less. The down payment also depends on each family, but if you can pay more than 20% in advance, it's beneficial because it obviously lowers the installment amount,” he analyzed.

Keys to evaluate before taking out a loan

Those considering this financing opportunity should carefully analyze several key factors. One of them is the initial down payment: it's usually around 20% of the property's value, although each bank has its own policies. The higher the down payment, the lower the financed amount and, therefore, the monthly payment.

Another key issue is interest rates. Public banks—such as Banco Nación, Banco Ciudad, and Banco Provincia—maintained relatively stable and competitive conditions in recent months. In contrast, several private banks adjusted their rates by half a percentage point or one percentage point, reflecting the general movement in the cost of money.

The loan term is also a relevant variable. Although the maximum term is usually 20 years, there isn't always a big difference between taking out a 15- or 20-year loan, but a shorter term means a higher monthly payment.

www.buysellba.com