All the Answers

Well-known member

Markets: the slight rebound on Wall Street moderates the decline in Argentine stocks and bonds - Infobae

Source:

Mercados: el leve rebote de Wall Street modera la baja que atraviesan las acciones y los bonos argentinos

Los indicadores norteamericanos siguen volátiles y el Dow Jones sube un 0,3%. Los ADR argentinos negocian con bajas de 2% en dólares. Los bonos Globales caen por sexta rueda seguida y el riesgo país vuelve a sobrepasar los 1.400 puntos

April 16, 2024

North American indicators remain volatile and the Dow Jones rises 0.3%. Argentine ADRs are trading down 2% in dollars. Global bonds fall for the sixth consecutive round and the country risk once again exceeds 1,400 points

Caution is imposed in international markets.

International markets operate with extreme caution this Tuesday, in line with the trend defined by Wall Street in the face of concern generated by corporate balance sheets, macroeconomic data and the conflict between Iran and Israel.

After six consecutive rounds of declines, the Dow Jones Industrial Average rose 0.3% at 11:30 a.m., as traders eyed a broader recovery with bond yields at multi-month highs and growing tensions in the Middle East. East. Meanwhile, the S&P 500 and the Nasdaq Composite were trading with slight declines.

The most optimistic tone comes when earnings reports came in before the bell rang. Shares of United Health rose more than 5% after the healthcare group beat quarterly profit estimates, even as it said it expects to receive $1.6 billion for a cyberattack in February.

Investors were also digesting more results from big banks: Bank of America reported first-quarter earnings fell 18% year over year as a key source of revenue weakened, while Morgan Stanley shares rose after beating expectations. Elsewhere, Bank of Ney York Mellon posted higher profits , while Johnson & Johnson reported a revenue loss. Also on the docket are results from United Airlines , among others.

Meanwhile, the threat of an open war breaking out between the enemies of the Middle East and dragging down the United States put the region on alert. Washington says it does not seek conflict with Iran, but will not hesitate to protect its forces and Israel.

In the midst of international tensions, Argentine stocks and bonds are going through a severe price correction, which relegates the moderate monthly decline in inflation in March and announced a new cut in the Central Bank's reference rate.

The ADRs and shares of Argentine companies that are traded in dollars on Wall Street operate with a majority of losses, of up to 2%, led by Cresud, Telecom and Pampa Energía .

“The two great international challenges were accentuated: the fear of recession and war,” reported VatNet Financial Research and estimated that it is time to “extreme caution.”

“In times of crisis, the dollar or United States bonds are the refuge,” said Mariano Sardans , from the FDI Wealth Manager.

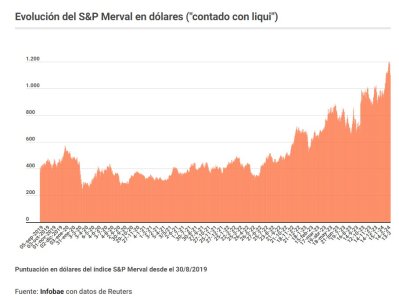

The S&P Merval of the Buenos Aires Stock Exchange falls 1.2% to 1,183,002 points . The panel of leading stocks, which on Thursday of last week had reached its highest level in dollars since June 2018, remains in the last three operating rounds an adjustment of 8.4% according to the “cash with liquid” parity.

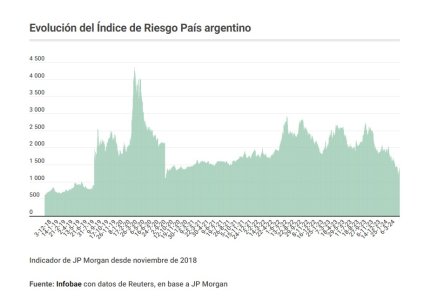

The Global bonds of the exchange - in dollars with foreign law - fell 0.9% on average on Wall Street this Tuesday, while the Bonares - with Argentine law - lost 0.7%, in the sixth consecutive drop for sovereign debt . In that sense, JP Morgan's country risk rises 36 units for Argentina, to 1,408 basis points , when US Treasury bonds reach the highest returns of the year due to investor risk aversion.

“There is a very good expectation in the financial market of what may come, that for the moment I am more cautious, I am not saying that it cannot turn out well, but it seems to me that there are quite a few things left unresolved and that is what is known.” "It will be revealed in the coming months," economist Guido Lorenzo said in statements to FM MIlenium .

“There is the disconnect between the real side and the financial side. The financial side out there has its head set more on the future, so it finds an expectation that things are headed, while the real side still does not reflect it. “You have that relative euphoria in the financial markets with a very strong depression,” he noted.

At the local political level, the Government of libertarian President Javier Milei seeks to endorse in Congress a decree with a package of measures that aims to deregulate the economy, which was already rejected by senators and must now be debated in the Chamber of Deputies.

“At the local level, the focus will be on the basic law that the Government will send to Congress,” said clearing and settlement agent Balanz Capital .