BuySellBA

Administrator

Housing is more expensive in the AMBA region: prices rise by up to 9% and rents exceed inflation - Ambito Financiero

Source:

www.ambito.com

www.ambito.com

July 30, 2025

By Jose Luis Cieri

Apartments in the Greater Buenos Aires (AMBA) are increasing in value due to demand, reduced supply, and rising costs. Rents and interest in smaller units have also increased.

Libertador Avenue corridor in the Vicente López district, the most sought-after in Greater Buenos Aires

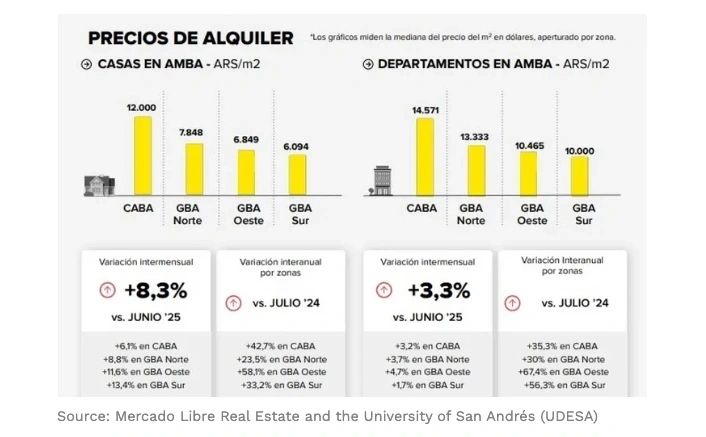

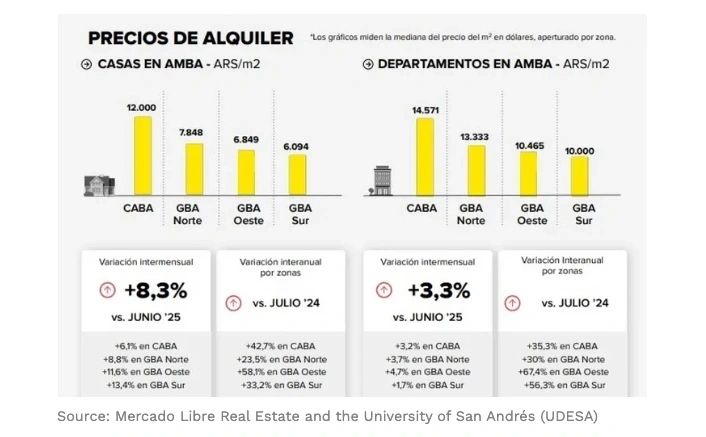

The real estate market in the Buenos Aires Metropolitan Area (AMBA) is experiencing a new cycle of increases. According to the joint report by Mercado Libre Inmuebles and the University of San Andrés (UDESA), apartment sales values rose 8.1% year-over-year on average, while rental prices increased 3.3% in July. In the city of Buenos Aires, apartment prices have accumulated a 9.2% increase compared to July 2024.

The increase in prices is not uniform. The northern region of Greater Buenos Aires registered a 5.8% year-over-year increase, the western region 4.5%, and the southern region 4.2%. Overall, the positive trend began in CABA in August 2023; in Greater Buenos Aires (GBA) North, in April of this year; in GBA South, in May 2024; and in GBA West, in January 2025.

The highest prices per square meter in Buenos Aires remain in Puerto Madero (US$5,434), followed by Palermo (US$3,466), Belgrano (US$3,225), and Recoleta (US$2,810). The middle ground is Agronomía (US$2,226), Caballito (US$2,438), and Retiro (US$2,373).

In terms of housing, the square meter in Buenos Aires averages US$1,326, while in the Greater Buenos Aires it varies between US$655 and US$858, depending on the area of the suburbs.

At the same time, demand for real estate for sale also intensified. The report revealed that contacts for apartments in Buenos Aires City increased 15.4% year-over-year. This recovery is linked to the upswing in mortgage lending and government signals aimed at facilitating transactions with unsecured funds.

Daniel Salaya Romera , of Salaya Romera Properties, explained that "the expectation of money laundering was channeled toward intermediation, not construction, with a significant, though limited, impact." He stated that "the government's initiative to encourage the use of dollars from the buffer has not yet resolved tax issues."

Among the new regulatory provisions, the government raised the threshold for real estate transactions that must be reported to the Financial Information Unit (UIF), increasing it from $62,680,000 (approximately US$53,500) to $235,050,000 (approximately US$200,000). The sector hopes this measure will boost sales of properties below this value.

A new simplified income tax regime for individuals was also implemented, eliminating the obligation to report assets at the beginning and end of the fiscal year. This measure eliminates the asset matching process, one of the tools used by the tax authorities to detect inconsistencies. Furthermore, the COTI (Tax Identification System), a requirement that required prior declaration of transactions exceeding $66,833,000, was eliminated.

“The accumulation of these measures is generating expectations, but it has not yet translated into more concrete sales,” explained Salaya Romera. “Apartment prices in Buenos Aires City began to rise in late 2023. Today, listings are more in line with actual closing prices, and existing units have increased 3.9% so far this year and 7.7% in the last twelve months.”

In Vicente López, one of the busiest areas in the northern suburbs, apartments also saw a rise in prices. “In that area, prices are around US$2,309 per square meter, similar to those in September 2021,” said Salaya Romera. “Since November 2023, when the change in the cycle was confirmed, the average price has increased by 6.8%. A 50 m2 one-bedroom apartment costs around US$112,000, and a two-bedroom apartment costs US$173,000.”

The specialist also highlighted the growing gap between used and new properties. "Since October 2023, new units have resumed an upward trend, driven by a 126% increase in construction costs. The gap between the price per square meter of a used property and a new one reached 28% in May, its highest level in at least five years," he indicated.

He also noted that units in the "underground" category are priced above new properties. "The average price of underground apartments is US$2,893/m2, 31% higher than used apartments and 2.2% higher than brand-new ones. A one-bedroom apartment costs around US$150,000, and a two-bedroom apartment is around US$225,000."

For his part, Leandro Gómez of Gómez Properties provided an overview of the market in Lanús and Avellaneda. “Today, demand is dominated by buyers inquiring about whether properties are eligible for a mortgage , in the range below US$100,000. These types of units are in short supply, and there is a lot of anticipation about how prices will move in the second half of the year,” he noted.

Gómez believes prices are steadily rising. “As lower-value units disappear, inquiries increase and push up the price. In the area, a one-bedroom apartment with 45 m² costs around US$90,000. Two-bedroom apartments with 80 m² cost between US$180,000 and US$200,000. Houses, depending on the square footage and location, range from US$250,000 to US$300,000.”

In Buenos Aires, housing prices per square meter rose 6.1% month-on-month, while in South GBA the increase was 13.4%. For apartments, the strongest increase was in West GBA, with 4.7%, followed by North GBA (3.7%), Buenos Aires (3.2%), and South GBA (1.7%).

Year-over-year, house rents increased 32.3% and apartment rents 36.3%, although in some areas the increases far exceeded this average. In Western Greater Buenos Aires, for example, apartment prices climbed 67.4% in one year. In Southern Greater Buenos Aires, it rose 56.3%, and in Buenos Aires, it rose 35.3%. Despite these increases, the report highlights that the rate remained below cumulative inflation in several areas of the Greater Buenos Aires (AMBA).

The study also noted a sharp increase in rental supply: between November 2023 and July 2025, the number of available apartments increased by 205.4%. This is linked to the regulatory change in Decree 70/2023, which repealed the 2020 Rental Law, allowing for adjustments to contractual conditions and facilitating inventory turnover.

In Buenos Aires, the neighborhood with the highest rent increase was Puerto Madero, with a 10.2% monthly increase. In Greater Buenos Aires, the largest increases were recorded in Ezeiza (houses) and Esteban Echeverría (apartments), with increases of 18.4% and 7.9%, respectively.

www.buysellba.com

Source:

Viviendas más caras en el AMBA: los precios suben hasta 9% y los alquileres superan la inflación

Los departamentos en AMBA se valorizan por demanda, menos oferta barata y suba de costos. También crecieron los alquileres y el interés por unidades chicas.

July 30, 2025

By Jose Luis Cieri

Apartments in the Greater Buenos Aires (AMBA) are increasing in value due to demand, reduced supply, and rising costs. Rents and interest in smaller units have also increased.

Libertador Avenue corridor in the Vicente López district, the most sought-after in Greater Buenos Aires

The real estate market in the Buenos Aires Metropolitan Area (AMBA) is experiencing a new cycle of increases. According to the joint report by Mercado Libre Inmuebles and the University of San Andrés (UDESA), apartment sales values rose 8.1% year-over-year on average, while rental prices increased 3.3% in July. In the city of Buenos Aires, apartment prices have accumulated a 9.2% increase compared to July 2024.

The increase in prices is not uniform. The northern region of Greater Buenos Aires registered a 5.8% year-over-year increase, the western region 4.5%, and the southern region 4.2%. Overall, the positive trend began in CABA in August 2023; in Greater Buenos Aires (GBA) North, in April of this year; in GBA South, in May 2024; and in GBA West, in January 2025.

The highest prices per square meter in Buenos Aires remain in Puerto Madero (US$5,434), followed by Palermo (US$3,466), Belgrano (US$3,225), and Recoleta (US$2,810). The middle ground is Agronomía (US$2,226), Caballito (US$2,438), and Retiro (US$2,373).

In terms of housing, the square meter in Buenos Aires averages US$1,326, while in the Greater Buenos Aires it varies between US$655 and US$858, depending on the area of the suburbs.

At the same time, demand for real estate for sale also intensified. The report revealed that contacts for apartments in Buenos Aires City increased 15.4% year-over-year. This recovery is linked to the upswing in mortgage lending and government signals aimed at facilitating transactions with unsecured funds.

Daniel Salaya Romera , of Salaya Romera Properties, explained that "the expectation of money laundering was channeled toward intermediation, not construction, with a significant, though limited, impact." He stated that "the government's initiative to encourage the use of dollars from the buffer has not yet resolved tax issues."

Among the new regulatory provisions, the government raised the threshold for real estate transactions that must be reported to the Financial Information Unit (UIF), increasing it from $62,680,000 (approximately US$53,500) to $235,050,000 (approximately US$200,000). The sector hopes this measure will boost sales of properties below this value.

A new simplified income tax regime for individuals was also implemented, eliminating the obligation to report assets at the beginning and end of the fiscal year. This measure eliminates the asset matching process, one of the tools used by the tax authorities to detect inconsistencies. Furthermore, the COTI (Tax Identification System), a requirement that required prior declaration of transactions exceeding $66,833,000, was eliminated.

“The accumulation of these measures is generating expectations, but it has not yet translated into more concrete sales,” explained Salaya Romera. “Apartment prices in Buenos Aires City began to rise in late 2023. Today, listings are more in line with actual closing prices, and existing units have increased 3.9% so far this year and 7.7% in the last twelve months.”

In Vicente López, one of the busiest areas in the northern suburbs, apartments also saw a rise in prices. “In that area, prices are around US$2,309 per square meter, similar to those in September 2021,” said Salaya Romera. “Since November 2023, when the change in the cycle was confirmed, the average price has increased by 6.8%. A 50 m2 one-bedroom apartment costs around US$112,000, and a two-bedroom apartment costs US$173,000.”

The specialist also highlighted the growing gap between used and new properties. "Since October 2023, new units have resumed an upward trend, driven by a 126% increase in construction costs. The gap between the price per square meter of a used property and a new one reached 28% in May, its highest level in at least five years," he indicated.

He also noted that units in the "underground" category are priced above new properties. "The average price of underground apartments is US$2,893/m2, 31% higher than used apartments and 2.2% higher than brand-new ones. A one-bedroom apartment costs around US$150,000, and a two-bedroom apartment is around US$225,000."

For his part, Leandro Gómez of Gómez Properties provided an overview of the market in Lanús and Avellaneda. “Today, demand is dominated by buyers inquiring about whether properties are eligible for a mortgage , in the range below US$100,000. These types of units are in short supply, and there is a lot of anticipation about how prices will move in the second half of the year,” he noted.

Gómez believes prices are steadily rising. “As lower-value units disappear, inquiries increase and push up the price. In the area, a one-bedroom apartment with 45 m² costs around US$90,000. Two-bedroom apartments with 80 m² cost between US$180,000 and US$200,000. Houses, depending on the square footage and location, range from US$250,000 to US$300,000.”

Locations

Regarding the rental market , the Mercado Libre-UDESA report revealed that housing prices in the AMBA region increased by 8.3% in July, and apartments by 3.3%. They outpaced inflation, which now averages 2% per month, primarily because owners are seeking to hedge against the economic downturn. However, demand doesn't immediately match these prices, and an apartment or house takes more than a month to rent. Owners and tenants even negotiate more, as there are often counteroffers on the initial listing price.In Buenos Aires, housing prices per square meter rose 6.1% month-on-month, while in South GBA the increase was 13.4%. For apartments, the strongest increase was in West GBA, with 4.7%, followed by North GBA (3.7%), Buenos Aires (3.2%), and South GBA (1.7%).

Year-over-year, house rents increased 32.3% and apartment rents 36.3%, although in some areas the increases far exceeded this average. In Western Greater Buenos Aires, for example, apartment prices climbed 67.4% in one year. In Southern Greater Buenos Aires, it rose 56.3%, and in Buenos Aires, it rose 35.3%. Despite these increases, the report highlights that the rate remained below cumulative inflation in several areas of the Greater Buenos Aires (AMBA).

The study also noted a sharp increase in rental supply: between November 2023 and July 2025, the number of available apartments increased by 205.4%. This is linked to the regulatory change in Decree 70/2023, which repealed the 2020 Rental Law, allowing for adjustments to contractual conditions and facilitating inventory turnover.

In Buenos Aires, the neighborhood with the highest rent increase was Puerto Madero, with a 10.2% monthly increase. In Greater Buenos Aires, the largest increases were recorded in Ezeiza (houses) and Esteban Echeverría (apartments), with increases of 18.4% and 7.9%, respectively.

www.buysellba.com