Piranha

Well-known member

In doing some research it is clear to see that consumer debt (personal loans, credit cards, et al) is shooting up. When you talk to people they say they are at their limit. I am reading posts about banks starting loans to pay off monthly condo expenses. These are troubling signals.

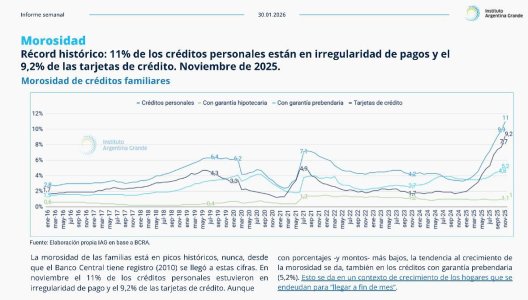

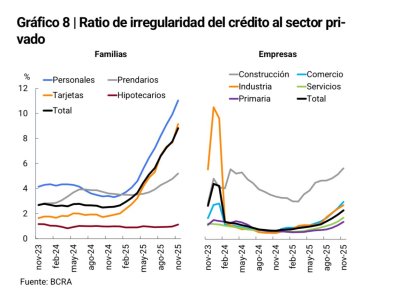

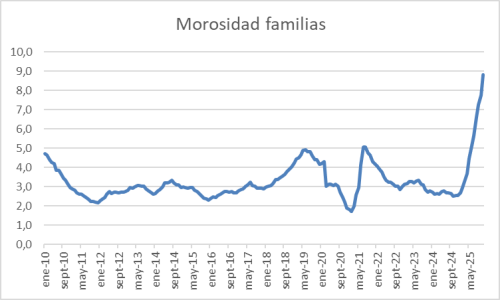

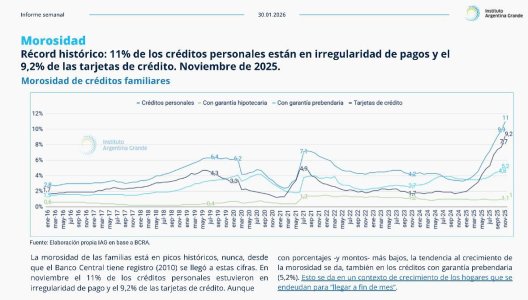

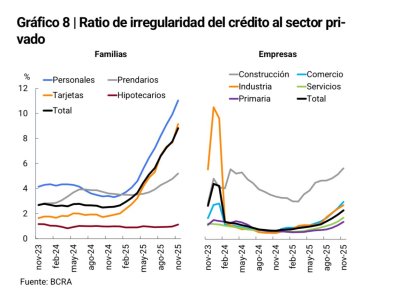

When people aren't paying their credit cards or personal loans it means they are in deep trouble. These default rates are up double digits, surpassing levels not seen since 2010 when the Central Bank began tracking this data. This is on top of rising unemployment.

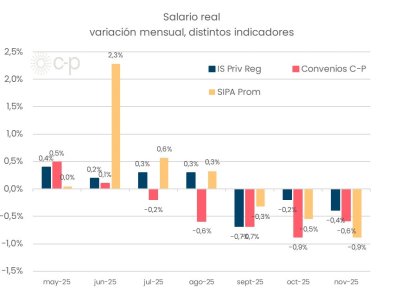

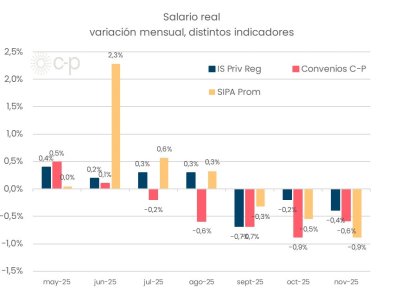

So all the posts talking about inflation outpacing salaries is valid and if this keeps up it is game over for Milei.

When people aren't paying their credit cards or personal loans it means they are in deep trouble. These default rates are up double digits, surpassing levels not seen since 2010 when the Central Bank began tracking this data. This is on top of rising unemployment.

So all the posts talking about inflation outpacing salaries is valid and if this keeps up it is game over for Milei.