BuySellBA

Administrator

Costs are falling and construction is picking up year-over-year: why rental profitability is growing - Ambito Financiero

Source:

www.ambito.com

www.ambito.com

August 21, 2025

A private report found falling costs measured in dollars, rising permits, and a widening price gap between under-construction and used units.

Even with economic decouplings and building values that accumulate a strong increase, the works continue, such as this one located on Lacroze Avenue, in Colegiales.

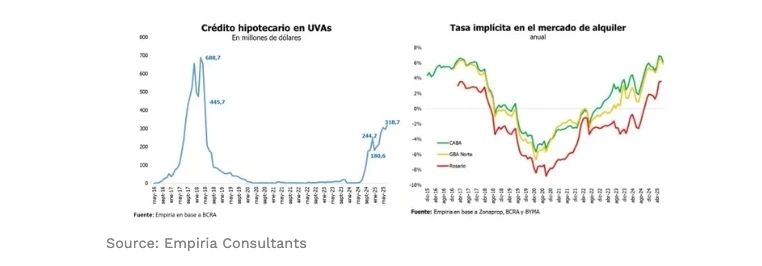

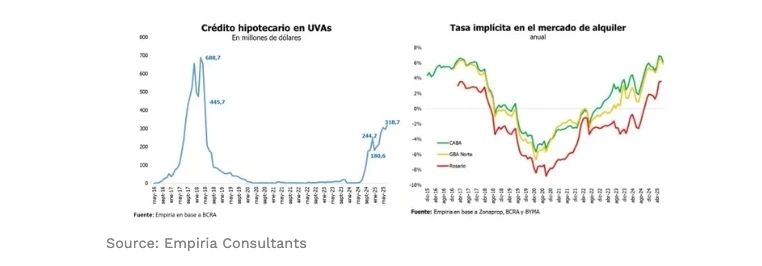

Construction in Argentina is going through a period of contrasts . According to a report by Empiria Consultores, in June, activity grew 0.9% monthly and accumulated a year-over-year increase of 13.9%. So far in 2025, the growth totals 10.8%. However, the sector ( in fact, these topics were discussed at the recent Real Estate Expo ) has not managed to consolidate a stable path: it has not recorded two consecutive months of expansion since last year, and the indicators show divergent signs.

Demand for inputs, for example, remains 20.2% below the November 2023 level, reflecting the caution of developers and builders.

Uncertainty dominates expectations: in July, 20% of business leaders surveyed anticipated a decline in activity for the third quarter, while only 10% predicted an improvement. This 10-point gap is the highest since mid-2024, when construction bottomed out.

The outlook, however, varies by region. In the City of Buenos Aires, permits fell by nearly 60% compared to 2022. Córdoba saw a cumulative decline of 20% over three years, and Santa Fe stabilized at a level 30% lower than in previous periods.

In contrast, Tucumán recorded a 43% growth, and Neuquén, a 28% growth. Mendoza also began to see increases in authorized surface area.

The drop in hard currency costs offers some relief to the sector, although margins remain constrained by uneven demand and difficulties in forecasting in the medium term. The recovery of profitability depends largely on continued price stability and a return to private sector volume.

In the City of Buenos Aires, the implicit rental market rate was 6.2% in July: higher than that of Banco Nación, but lower than that of other financial institutions. In Greater Buenos Aires, the estimate was 5.8%, while in Rosario it remained low and only reached 3.6% in June.

The report warns that, with the exception of Banco Nación, mortgage loans are perceived as expensive compared to rents at most banks. Demand, however, depends not only on financial calculations, but also on confidence in macroeconomic stability and repayment capacity.

The most notable feature is the growing gap between existing and existing units. In June, existing square footage increased by just 0.1%, while existing square footage rose by 1%. Since November 2023, existing square footage has accumulated a 9% increase, compared to a 25% jump in units under construction.

The gap reached a record high of 33.5% in Buenos Aires City. In Greater Buenos Aires North, the average square meter climbed to $2,329 in July, a 0.2% monthly increase. There, under construction units also made the difference, with a 0.6% increase. In the province, the gap between new and used units stands at 24%, nine points lower than in the capital, although still at a record high.

The key will be the evolution of private construction and the ability to sustain the recovery of mortgage lending. Meanwhile, the rental market remains an alternative way to access housing, and the growing gap between existing units and used properties is redefining investment strategies.

www.buysellba.com

Source:

Disminuyen costos y la construcción repunta a nivel interanual: por qué crece la rentabilidad de alquileres

Un informe privado detectó baja en costos medidos en dólares, permisos en alza y mayor brecha de precios entre unidades en pozo y usadas.

August 21, 2025

A private report found falling costs measured in dollars, rising permits, and a widening price gap between under-construction and used units.

Even with economic decouplings and building values that accumulate a strong increase, the works continue, such as this one located on Lacroze Avenue, in Colegiales.

Construction in Argentina is going through a period of contrasts . According to a report by Empiria Consultores, in June, activity grew 0.9% monthly and accumulated a year-over-year increase of 13.9%. So far in 2025, the growth totals 10.8%. However, the sector ( in fact, these topics were discussed at the recent Real Estate Expo ) has not managed to consolidate a stable path: it has not recorded two consecutive months of expansion since last year, and the indicators show divergent signs.

Demand for inputs, for example, remains 20.2% below the November 2023 level, reflecting the caution of developers and builders.

Uncertainty dominates expectations: in July, 20% of business leaders surveyed anticipated a decline in activity for the third quarter, while only 10% predicted an improvement. This 10-point gap is the highest since mid-2024, when construction bottomed out.

Mixed signals

Leading indicators echo this duality. Cement shipments increased 2% in July compared to June, while the Construya Index —which measures private activity—decreased 0.4%. Meanwhile, construction permits showed a year-over-year increase of 4.1% in June, marking five consecutive months of improvements.The outlook, however, varies by region. In the City of Buenos Aires, permits fell by nearly 60% compared to 2022. Córdoba saw a cumulative decline of 20% over three years, and Santa Fe stabilized at a level 30% lower than in previous periods.

In contrast, Tucumán recorded a 43% growth, and Neuquén, a 28% growth. Mendoza also began to see increases in authorized surface area.

Falling costs

The recent depreciation of the peso is impacting costs measured in dollars, according to the Empiria report. In July, construction costs fell 4% monthly, and another 5% drop is projected for August. If confirmed, the second half of the year would close with a cumulative decline of 11% compared to June.The drop in hard currency costs offers some relief to the sector, although margins remain constrained by uneven demand and difficulties in forecasting in the medium term. The recovery of profitability depends largely on continued price stability and a return to private sector volume.

Credit and rent

The comparison between mortgage loans and rent has become central to understanding the market. The logic is that, as long as the cost of renting a property is lower than the monthly payment for a loan for the same property, renting is cheaper than going into debt.

In the City of Buenos Aires, the implicit rental market rate was 6.2% in July: higher than that of Banco Nación, but lower than that of other financial institutions. In Greater Buenos Aires, the estimate was 5.8%, while in Rosario it remained low and only reached 3.6% in June.

The report warns that, with the exception of Banco Nación, mortgage loans are perceived as expensive compared to rents at most banks. Demand, however, depends not only on financial calculations, but also on confidence in macroeconomic stability and repayment capacity.

Gap between used and well

The average price per square meter for sale in the city stood at US$2,440 in July, 0.5% higher than in June and 6.7% higher than a year earlier. Since April, increases have continued at this monthly pace, suggesting a slowdown in the rate of adjustment.The most notable feature is the growing gap between existing and existing units. In June, existing square footage increased by just 0.1%, while existing square footage rose by 1%. Since November 2023, existing square footage has accumulated a 9% increase, compared to a 25% jump in units under construction.

The gap reached a record high of 33.5% in Buenos Aires City. In Greater Buenos Aires North, the average square meter climbed to $2,329 in July, a 0.2% monthly increase. There, under construction units also made the difference, with a 0.6% increase. In the province, the gap between new and used units stands at 24%, nine points lower than in the capital, although still at a record high.

Perspectives

The sector is experiencing conflicting signals: overall activity shows year-over-year increases, and the drop in dollar-denominated costs improves margins, but leading indicators and business expectations reflect fragility.The key will be the evolution of private construction and the ability to sustain the recovery of mortgage lending. Meanwhile, the rental market remains an alternative way to access housing, and the growing gap between existing units and used properties is redefining investment strategies.

www.buysellba.com