BuySellBA

Administrator

Buying a home for up to $100,000: What banks offer and what to look for before choosing a mortgage loan - Ambito Financiero

Source:

www.ambito.com

www.ambito.com

August 26, 2025

The 20-year UVA loan leverage finances up to 75% of the property's value. Detailed down payments and differences between lenders.

A couple completed the purchase of their home with a mortgage loan and received congratulations from the notary. Pexels

According to a report by the Tejido Urbano Foundation , mortgage loans grew 60% in the first six months of 2025 compared to 2024. Between January and July, more than 19,000 loans were granted, marking a six-year high and reopening competition between public and private banks.

The reappearance of housing financing resulted in 24 active lines of financing, with very different conditions. The proposals are concentrated in two main types: UVA loans, which are adjusted for inflation, and new dollar-denominated schemes that are beginning to be channeled through the capital market ( the first Argentine closed-end fund in dollars ).

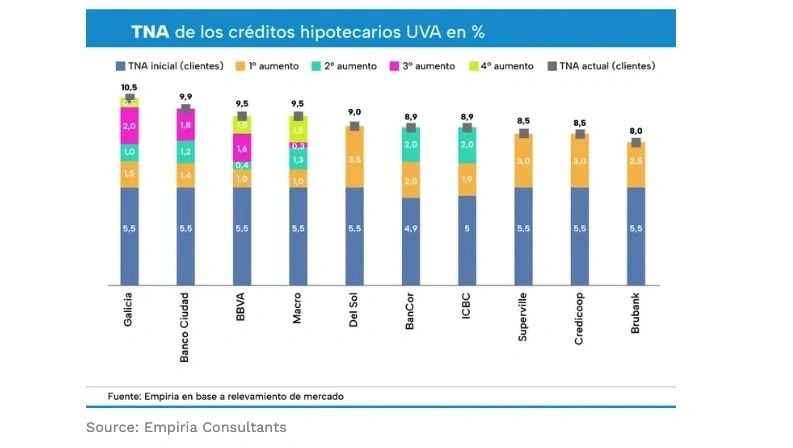

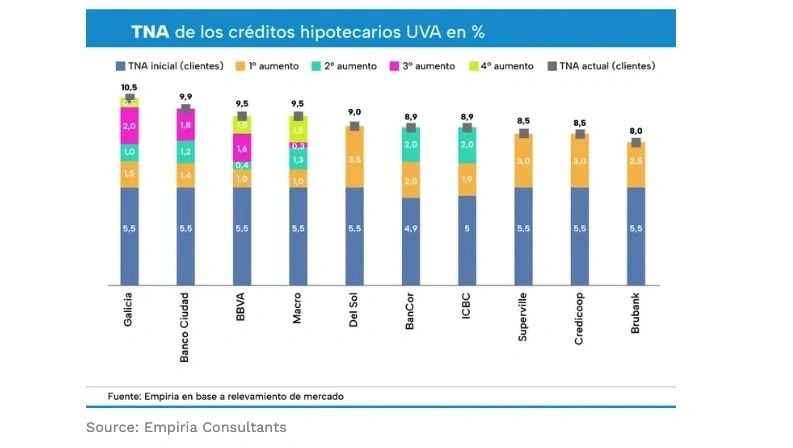

Banks typically finance between 70% and 80% of the property's value, requiring applicants to have at least US$20,000 or US$30,000 in prior savings, equivalent to 20% to 30% of the value of a US$100,000 property, for example. They also require that the monthly payment not exceed 30% to 35% of the net family income. It's important to note the proposed interest rates ( infographic below ), which have already been raised several times since the plans were reintroduced.

A private survey conducted by economist and professor at the National University of La Matanza (UNLAM), Andrés Salinas, compared the initial down payment for a property worth $100,000, financed over 20 years. The analysis showed differences of up to $435,000 between the cheapest and most expensive options.

Initial installments for a loan of US$100,000 (20 years), below are some examples:

The lowest rate corresponds to Banco Nación , and the highest to Galicia . The difference reveals that it's not just the interest rate that makes the difference, but also the way each institution structures the initial loan amount.

Among the market options, Supervielle offers mortgage loans at a UVA rate + 8.5%, with terms of up to 15 years and financing of up to 70% of the property value for permanent or non-permanent housing. There are no maximum amounts and, in addition to purchase, they include lines for renovations (up to 50% of the project value, 10-year term) and expansions (up to 60%, 15 years). These loans are available to employed clients with a minimum income of $2,500,000, the option to add a spouse, partner, or parents, and with a minimum employment seniority requirement of 12 months in the private sector and 18 months in the public sector.

The loans finance up to 75% of the property's value (or 65% if additional guarantors are required), with a maximum term of 20 years. A key condition is that the down payment not exceed 25% of the household's income, which aims to safeguard repayment capacity.

Mariela Schenone , CEO of Metro Futuro, stated that "with high inflation, fixed-rate loans have disappeared, and what remains are UVA loans, with an additional cost ranging from 4.5% to 13% annually depending on the client's profile." Regarding dollar-denominated plans, she clarified that "while they represent an important step as a sign of openness to the private market, they are not yet a real solution for most families because they require at least 65% of the property's value to be saved."

Private banks' competition focuses on attracting middle-class individuals who have the capacity to save. BBVA, ICBC, Macro, and Galicia show differences in annual nominal interest rates and down payment amounts, creating a situation where comparisons have become essential.

He emphasized that inflation is the main barrier: "In Argentina, it has become almost impossible to project 20 or 30 years down the road. Without predictability, families are hesitant to take on debt, and banks are hesitant to lend."

In his analysis, González Rouco emphasized that, in addition to stability, tax incentives are needed to fund housing, along with a capital market that can extend terms and lower rates.

Two-bedroom apartments are among the most popular for mortgage loans.

Among younger generations, the fear of debt is more pronounced. Schenone opined that "many prefer the mobility that renting offers rather than burdening themselves with a 20-year mortgage." However, he emphasized that "considering property appreciation is key: not all neighborhoods grow equally, and a strategic purchase can become a safeguard for future value."

Added to this warning is the need to consider other costs associated with the process:

In addition, there are recurring costs:

"A loan isn't just a payment, it's a life project," Schenone summarized. He concluded: "The comparison between the rent paid and the bank's monthly payment is a first step, but the decision also depends on the family's willingness to transform savings into assets."

www.buysellba.com

Source:

Comprar la casa de hasta u$s100.000: qué ofrecen los bancos y qué mirar antes de elegir el crédito hipotecario

El apalancamiento crediticio UVA a 20 años financia hasta el 75% del valor de la propiedad. Cuotas iniciales y diferencias entre entidades en detalle.

August 26, 2025

The 20-year UVA loan leverage finances up to 75% of the property's value. Detailed down payments and differences between lenders.

A couple completed the purchase of their home with a mortgage loan and received congratulations from the notary. Pexels

According to a report by the Tejido Urbano Foundation , mortgage loans grew 60% in the first six months of 2025 compared to 2024. Between January and July, more than 19,000 loans were granted, marking a six-year high and reopening competition between public and private banks.

The reappearance of housing financing resulted in 24 active lines of financing, with very different conditions. The proposals are concentrated in two main types: UVA loans, which are adjusted for inflation, and new dollar-denominated schemes that are beginning to be channeled through the capital market ( the first Argentine closed-end fund in dollars ).

Banks typically finance between 70% and 80% of the property's value, requiring applicants to have at least US$20,000 or US$30,000 in prior savings, equivalent to 20% to 30% of the value of a US$100,000 property, for example. They also require that the monthly payment not exceed 30% to 35% of the net family income. It's important to note the proposed interest rates ( infographic below ), which have already been raised several times since the plans were reintroduced.

A private survey conducted by economist and professor at the National University of La Matanza (UNLAM), Andrés Salinas, compared the initial down payment for a property worth $100,000, financed over 20 years. The analysis showed differences of up to $435,000 between the cheapest and most expensive options.

Initial installments for a loan of US$100,000 (20 years), below are some examples:

- Banco Nación: $645,821.

- Banco Ciudad: $712,903.

- Banco Supervielle: $826,103.

- ICBC Bank: $997,705.

- Brubank Bank: $907,850.

- BBVA Bank: $946,714.

- Banco Galicia: $1,081,646.

- Banco Macro: $866,921.

- Credicoop Bank: $882,103.

- Banco del Sol: $914,156.

- Comafi Bank: $850,572.

The lowest rate corresponds to Banco Nación , and the highest to Galicia . The difference reveals that it's not just the interest rate that makes the difference, but also the way each institution structures the initial loan amount.

Among the market options, Supervielle offers mortgage loans at a UVA rate + 8.5%, with terms of up to 15 years and financing of up to 70% of the property value for permanent or non-permanent housing. There are no maximum amounts and, in addition to purchase, they include lines for renovations (up to 50% of the project value, 10-year term) and expansions (up to 60%, 15 years). These loans are available to employed clients with a minimum income of $2,500,000, the option to add a spouse, partner, or parents, and with a minimum employment seniority requirement of 12 months in the private sector and 18 months in the public sector.

Promotional line for CABA

Banco Ciudad stands out in its offering by offering promotional rates for certain neighborhoods in the southern and central areas of Buenos Aires, as part of its housing incentive policy in specific sectors. For these areas (La Boca, Barracas, Parque Patricios, Lugano, San Telmo, Monserrat, and part of Balvanera, among others), the initial rate is UVA + 3.5% APR , one of the most competitive on the market. For the rest of the city, the rate is UVA + 5.5% APR .The loans finance up to 75% of the property's value (or 65% if additional guarantors are required), with a maximum term of 20 years. A key condition is that the down payment not exceed 25% of the household's income, which aims to safeguard repayment capacity.

The new scenario

The return of peso-denominated loans with UVA adjustments was once again the most widely used option. They allow for a lower starting payment compared to fixed rates, but with the downside of the risk of the payment skyrocketing if inflation doesn't moderate.

Mariela Schenone , CEO of Metro Futuro, stated that "with high inflation, fixed-rate loans have disappeared, and what remains are UVA loans, with an additional cost ranging from 4.5% to 13% annually depending on the client's profile." Regarding dollar-denominated plans, she clarified that "while they represent an important step as a sign of openness to the private market, they are not yet a real solution for most families because they require at least 65% of the property's value to be saved."

Conditions and restrictions

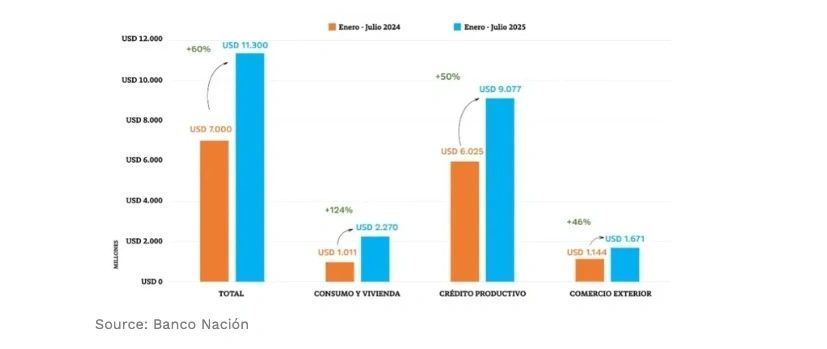

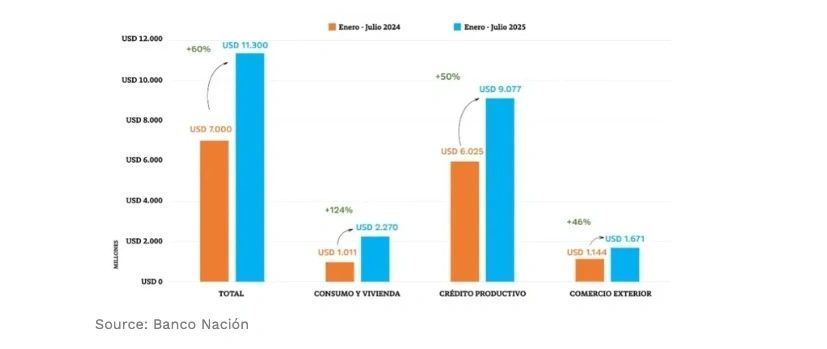

The Banco Nación report (see chart) confirmed that the institution granted loans totaling US$11.3 billion in the first seven months of the year, representing a 60% increase compared to the same period in 2024. Of that total, US$2.27 billion was allocated to consumer spending and home purchases, a year-over-year increase of 124%. Since May 2024, more than 10,000 mortgages have been approved through the "+Hogares con BNA" program.

Private banks' competition focuses on attracting middle-class individuals who have the capacity to save. BBVA, ICBC, Macro, and Galicia show differences in annual nominal interest rates and down payment amounts, creating a situation where comparisons have become essential.

Macroeconomic factors

Federico González Rouco , an economist specializing in the real estate market at Empiria Consultores, noted that "mortgage loans are the most powerful tool for addressing the housing shortage, but without macroeconomic stability, it is very difficult to achieve scale."He emphasized that inflation is the main barrier: "In Argentina, it has become almost impossible to project 20 or 30 years down the road. Without predictability, families are hesitant to take on debt, and banks are hesitant to lend."

In his analysis, González Rouco emphasized that, in addition to stability, tax incentives are needed to fund housing, along with a capital market that can extend terms and lower rates.

Rent or buy

The dilemma of renting or going into debt plagues thousands of families. Salinas noted that "renting is seen as throwing money away, but it offers flexibility. A loan, on the other hand, provides financial stability, although it means taking on long-term debt."

Two-bedroom apartments are among the most popular for mortgage loans.

Among younger generations, the fear of debt is more pronounced. Schenone opined that "many prefer the mobility that renting offers rather than burdening themselves with a 20-year mortgage." However, he emphasized that "considering property appreciation is key: not all neighborhoods grow equally, and a strategic purchase can become a safeguard for future value."

Details to keep in mind

What type of property they're going to buy is a dilemma. Schenone explained: "A move-in-ready home isn't the same as one that requires major renovations. Often, the loan is enough for the purchase, but then unaccounted-for expenses arise."Added to this warning is the need to consider other costs associated with the process:

- Stamp Duty : between 1.5% and 2% of the property value, depending on the jurisdiction.

- Bank and appraisal commission : between 0.5% and 1% of the requested amount.

- Notary fees : approximately 2% of the property value.

- Taxes and registration fees : approximately 1.5%.

- Certifications and registrations : up to 0.5%.

In addition, there are recurring costs:

- Life insurance : mandatory, between 0.1% and 0.2% of the annual balance.

- Fire insurance : similar to life insurance.

- Municipal taxes : vary by location.

Strategies

Specialists agree that there are three keys to making a mortgage loan sustainable:- Take advantage of prepayment to reduce the actual term of the debt.

- Choosing the right time to buy during a cycle of low property prices.

- Share credit with co-debtors to expand earning capacity and access higher amounts.

"A loan isn't just a payment, it's a life project," Schenone summarized. He concluded: "The comparison between the rent paid and the bank's monthly payment is a first step, but the decision also depends on the family's willingness to transform savings into assets."

www.buysellba.com